The National Federation of Independent Business has reported that nearly 64 percent of the businesses have unpaid invoices which are 60 days old. These types of late or non-payments often have multiple reasons. It is critical to consider all the aspects and improve any shortcomings in the business functioning. Unpaid invoices certainly hurt the business. So, ideally, companies should consider implementing multiple strategies to get their payment and maintain the smooth functioning of the services and feedback. Delinquent customers can always be frustrating, but businesses can take a few positive actions to handle these customers effectively.

Here are a few strategies that the agency can follow to handle delinquent customers:

Understand and Talk to the customers

There can be possibilities where the customer is willing to release the invoice, but he faces some unavoidable circumstances. These factors can be professional or personal, and businesses should listen to such concerns. The very first approach is to drop them a customized email mentioning the details of the invoice and requesting them to acknowledge the same.

Even after multiple attempts, the time has come to initiate a conversation if there is no reaction. When it’s time to have a conversation, the first thing to do is calmly center yourself and relax. Having a short and precise conversation can help understand the situation completely, and some mutual decisions can be taken.

During the conversation, don’t just keep mentioning the dues. Let the customer talk and express himself as to what is holding them back. If they have a fair point, then take the necessary steps to solve the problem, and if not, carefully and politely convince them to act as soon as possible. After the conversation, handing over one last deadline can positively approach closing the talk.

Detailed and Self-Descriptive Contract

Accurate and satisfactory documentation is crucial for all aspects of any business. It becomes even more critical while dealing with recurring invoices or services that do not have a specific fixed service charge. It is essential to get all details in writing so that no issues are faced down the road. For instance, if the client is aware they owe fees for overdue expenses, they will be less likely to escape – and if they do, they will be forced to pay. But if failed to set up a contract, then nothing is guaranteed.

Moreover, make sure that the contract is detailed and clearly explains all the deliverables and milestones. Curate the contract so that even someone with a minimal idea about the project can figure out the details. The contract should have minute details and all the deadlines for both parties. Also, try to include the project’s scope in the initial agreement as things tend to move around quickly in a service-based business.

Have a Follow-Up Strategy

Businesses often have to deal with similar problems repetitively, and indeed delinquent customers are not going anywhere soon. Even customers with the best intentions can fall on hard times and be delinquent, so there is no reason to take it personally or make assumptions. So, having a chronological strategy will prove beneficial.

Following up regularly with customers who ignore payments has seen some success in the past. So, the best method is to schedule your follow-up strategy before the amount gets due. This acts as a gentle reminder to the customer about all the agreements that have been made in the contract.

So, companies should try to minimize the delinquent customers rather than just dealing with them after project completion. Furthermore, even though the business tried hard enough, there will be some delinquent customers whom the company will have to deal with separately.

Ask for deposits and allow payments in installments

Though there are instant expenses that service-based businesses need to bear on the project’s initiation, it would be a great option to clear out some part of the invoice upfront so that the dues don’t seem an impossible task to retrieve. Taking a deposit at the start of the project will help work without worrying much about further payment and will also be a positive start to the client-business relationship.

If the customer is not willing to put down the deposit, there are fewer chances that they will pay invoices in time. This is often evident from the start; future invoices will likely be cleared if there is no issue with down payments.

Further, if the deposit is made or the company is ready to move forward without the warranty, the next step is to allow the customer to make the payment in installments. This is one of the best methods while dealing with delinquent customers. Rather than asking for a large sum at once, the amount can be divided into various feasible installments so that the customer can willingly release the invoice and a significant amount of money keeps coming into the company.

Offer Early payment discounts

Offering special discounts is always an appreciated gesture. It makes the customer feel welcomed and portrays a positive image of the company. Discounts can be of various types, the major one being on the projects that are heavily billed.

Early discounts also improve the chances of getting paid. When given significant early discounts, customers tend to release the invoice sooner. The deal can be split in terms of the due date of payment. If the customer releases the invoice before a specific date, he can be rewarded for the gesture and given the maximum discount possible. These discounting methods will also benefit organic marketing, as word of mouth will spread solid and fast.

Be Humble and Polite

While dealing with delinquent customers, it is crucial to take small and careful steps. The goal is simple, to figure out the problem and how you can get paid. So, following a precise and humble approach is vital.

Discussing the problem and then coming up with possible solutions that both parties agree on is the only option. During the conversation, make sure that the customer has a positive image of the company and is not feeling threatened or forced. The client must feel that the company understands his situation and is willing to devise a personalized method to work the payments.

Furthermore, try to create a sense of mutual empathy. Let the customers know how their delinquent balance affects the business and remind them that, like them, the company also relies on the cash flow. A polite approach will undoubtedly be more effective than just complaining and threatening the customer. This also adds to the risk of losing the customer for further projects and can negatively impact the market capture of the business.

Keep improving the in-house payments system

Often lack of various facilities for payments can be the concern of many delinquent customers. So, try to accommodate full payment options to have at least one alternative to every payment gateway.

The in-house system should automatically have the basic templates to deal with similar delinquent payments. Also, check for changes in payment patterns. If you see them declining, take immediate action. Proactively contacting the customer can save future problems and, perhaps, help a historically good customer get through a rough patch.

Consider Outsourcing

Companies work hard on various strategies to effectively deal with delinquent customers. Still, there can be instances where a lot of time, energy, and resources are wasted on this task. When the company believes that it has tried all the solutions, outsourcing is the best option.

There are two significant ways the company can make this happen: collection agencies and factoring services. Collection agencies are specialized companies when it comes to delinquent customers. These agencies typically work in recovering more than 90 days old invoices. As they have the experience and tried tactics, they are one of the go-to agencies for many businesses.

While collection agencies go to the customer, factoring services work slightly differently. With a factoring service, you sell your accounts receivable to a company for a certain percentage of the account’s value. The service then advances you the money within a few days. Then the factoring service will collect your customers’ payments and send the rest of the cash to you, minus the service fee.

Indeed, factoring services work more complicatedly, and it is strongly advised to research them in detail before any engagement.

Take Legal Help

Taking legal assistance should undoubtedly be one of the last options to handle delinquent customers. Businesses should not directly jump to legal frameworks as there is always the possibility of dealing with these problems internally and devising a mutual decision.

The primary options are hiring an attorney or taking the case to a small claims court. An attorney is perfect for analyzing the situation with an unbiased opinion. His first step would be to check if it is worth the fight, and if it is, he will proceed to verify all the legal documents. If everything seems reasonable, he will start the legal process to settle the claims.

While considering the small claims court, the process is not simple, and the amount of money being asked should be worth the time and effort.

So, these were some of the methods that the business can adopt to handle delinquent customers effectively. There is certainly no one approach to deal with the situation, but trying various ways can help understand which method best suits the business.

Try to shuffle through these methods and, in the end, devise a personalized approach to dealing with delinquent customers. Also, companies should try to focus on multiple aspects to avoid clients getting converted to delinquency.

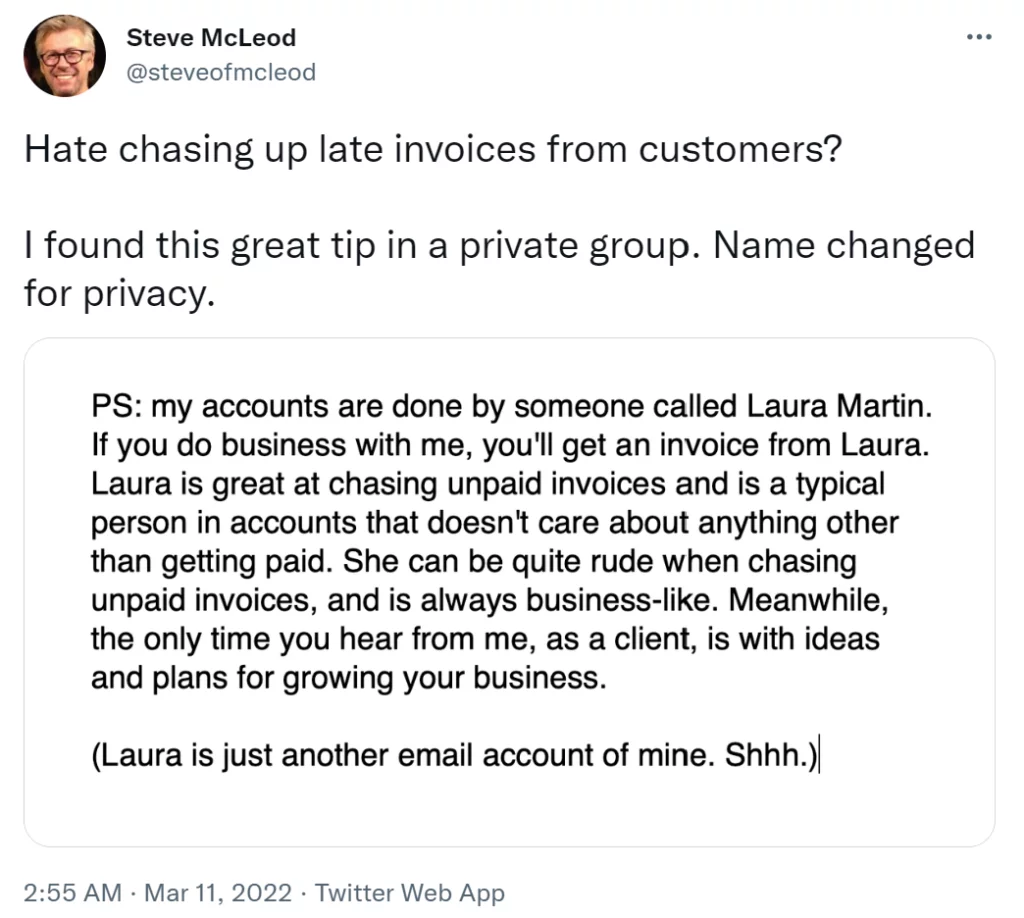

Bonus Tip: Use your alter ego

If you are a small SEO agency, you probably don’t have a dedicated accounts receivable person. It can be surprisingly effective in the early days to “invent” a persona for this role. Steve McLeod explains this on Twitter in this rather tongue-in-cheek tweet:

Although we don’t recommend over-using this approach, using it in a small dose can be surprisingly effective in getting clients to pay on time.

Got any tips for dealing with delinquent customers? Hit us up on twitter and join the discussion.