If you use WordPress to power an online store, WooCommerce is probably what you’re using. If you are, you’re in good hands!

The most popular eCommerce platforms in the world is WooCommerce. How? Check out theses impressive statistics provided by HostingTribunal.com to believe:

- WooCommerce is currently used by more than 4 million websites.

- Approximately 7% of websites on the internet use WooCommerce.

- WooCommerce powers over 28% of all online stores and eCommerce sites.

- For WooCommerce, there are almost a thousand plugins.

As you can tell, WooCommerce is very well-liked. You have a ton of options because WooCommerce is compatible with over a hundred payment gateways.

Factors to Consider When Assessing WooCommerce Payment Gateways

- Transaction Fee

Every time a card is charged or a purchase is made, a different set of transaction fees is applied by each payment gateway. These fees typically consist of two parts:

A portion of the exchange. The majority of transaction fees range from 2.5 to 3.5%.

A nominal charge per transaction. Typically, this costs $0.30.

Although each payment gateway has a unique transaction fee, most are competitive with one another. The specific fee charged will also vary based on the nature of the transaction, such as whether it is made with a chip credit card, an invoice, or another method.

| Payment Gateway | Transaction Fee |

| Stripe | 2.9% + 0.30 per transaction |

| PayPal Pro | 2.9% + 0.30 per transaction |

| Square | 2.65% + $0.30 per transaction |

| Authorize.net | 2.9% + 0.30 per transaction |

| Amazon Pay | 2.9% + 0.30 per transaction |

| Apple Pay | None |

| Alipay | Free |

- Operating Expenses

You’ll need to be concerned about other fees as well, which is unfortunate. Additionally, some payment gateways impose monthly fees, added costs for specific kinds of transactions, and other fees.

Make sure a gateway will be compatible with the kind of business you have before choosing it. Depending on the products you sell, you might be charged extra by some payment gateways for recurring or subscription-based payments, while other gateways don’t even provide the option.

Avoid selecting a service with high international fees if you intend to sell primarily to customers outside of your home country. Avoid using a service that has high offline fees if your customers prefer to pay with checks or cash rather than debit cards.

- WooCommerce Compatibility

If your payment gateway has WordPress plugin, things are much simpler. For instance, WooCommerce offers plugins for a wide range of gateways, including Stripe, PayPal Pro, Square, Authorize.net, and many more.

Long-term, using one of these will greatly simplify life. The setup and maintenance on your end are significantly reduced because these plugins manage the connection between WooCommerce and their respective payment gateways automatically. Without them, you’ll have to connect the different steps manually, which can be very challenging if you’re not familiar with the technology.

- Effortless Use

Being an entrepreneur is challenging. Avoid making things more difficult by selecting a payment processor that is challenging to use. Financial services are already extremely complex; there is no need to make them even more so!

It’s well known that some services are simpler to use than others. For instance, over the past ten years, Stripe has established a reputation as the easiest-to-use payment processors available. Additionally, Square is made to be plug-and-play with very little setup needed.

- Type of Payment Gateway

There are several different types of payment gateways, while others will demand that your customers make payments directly on their secure website, while some will let you display the entire payment process on your own website. Since it appears more professional, you should generally use a payment gateway that is on your website. If your preferred payment gateway does not permit you to do so, it is not a deal-breaker.

- The Customer’s Options for Payment

While some payment gateways only let you accept credit cards, others also let you accept bank transfers, Bitcoin, and PayPal. More payment options for your users are better. It’s best to accept as many payment methods as you can because some clients will only be able to pay you using particular ones. There are generally no drawbacks to having a variety of options.

- Support for Your Nation

Payment gateways are frequently geographically constrained due to legal restrictions, unlike many other online businesses. You might experience some difficulties using American payment processors if you’re, say, in the Middle East or Africa. It is also advantageous if the business employs support staff who can speak your language. This is crucial for complex technical issues because communication is crucial in these situations. Nothing is more frustrating than attempting to communicate a complex issue to a person who does not understand you!

- Currency

Similarly, you must confirm that your payment gateway offers reasonable currency conversion and supports it. Additionally, some gateways charge exorbitant fees for currency transfers, particularly for rare currencies.

Offering it as an alternative is always a great idea because customers prefer to pay in their own currency, which will increase sales. It also gives the impression that your store is focused on the global market, which is excellent for your brand’s image.

- Security

Security is the most crucial factor when it comes to payments, to sum up. You leave both you and your customers open to data loss and other problems if your payment process isn’t secure. That covers issues with technology, finances, and even the law. Thankfully, as long as you use a payment gateway properly, virtually every one is secure. The majority make it simple to comply with PCI and other local/regional laws. Customers must feel confident in you before they will purchase from you. You can convey that buying from you is secure and dependable by demonstrating that you have a secure payment system in place.

The Top WooCommerce Payment Gateways

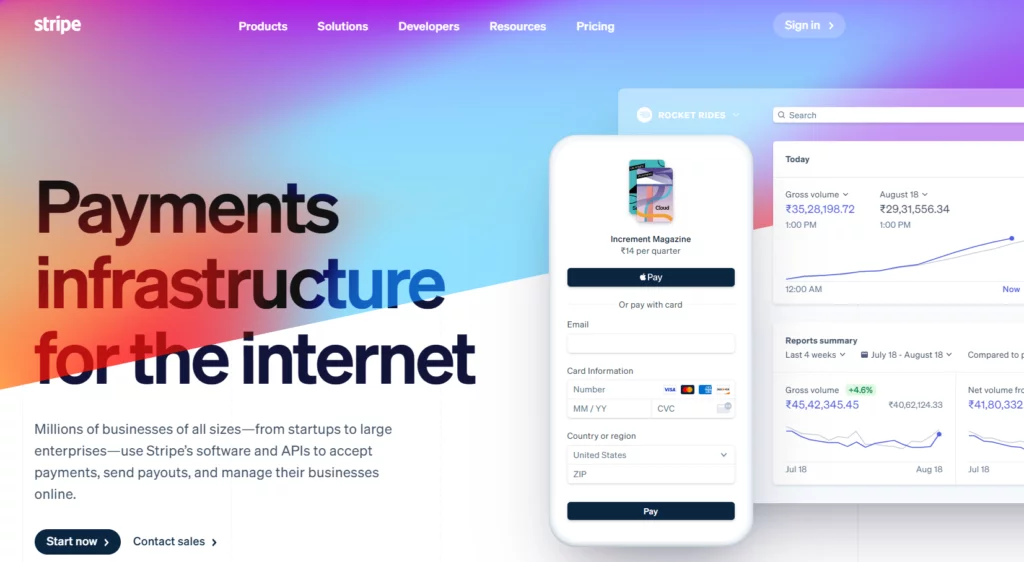

Stripe

Due mainly to its user-friendly interface, developer-friendly setup instructions, and clean design, Stripe is one of the market’s most widely used payment gateways. Millions of companies, such as Shopify, Amazon, Peloton, Squarespace, and Kickstarter, use Stripe.

You can accept more than a dozen different payment methods through editable forms. You can embed the forms on your website.

The dashboard’s reporting capabilities include the following:

- Managing refunds and disputes.

- Managing monthly totals by category.

- Tracking integrations.

- Monthly transaction history.

Additionally, WooCommerce and Stripe work very well together, enabling you to embed the payment form on your website. This is very helpful and increases customers’ chances to purchase.

To guarantee that the payments made by your clients are always secure, the form itself is PCI compliance optimized. You can accept all standard debit and credit cards from more than 130 different currencies and nations.

Main Features:

- Acceptance of 12+ payment options

- Embeddable checkout

- Ability to create stunning forms with Stripe Elements

- The simplicity of PCI compliance.

- Invoice

- Availability of the WooCommerce plugin

- Financial reporting

- Customizable design

Pros:

- • Features and documentation geared toward developers

- Excellent customer service reputation

- Costs that are in line with the industry average

Cons:

- Not accessible in all nations

Available Regions:

Most of the 42 countries where Stripe is available are in Europe and North America. Australia, Singapore, Malaysia, New Zealand, India, Brazil, and Hong Kong can also buy it.

Payment Options:

More than a dozen payment options are supported by Stripe, including credit and debit cards, Apple Pay, AliPay, Google Pay, and others. The options are based on your location and account type.

Fees:

- International charges are an additional 1%

- If currency conversions are necessary, add 1%

- Stripe charges 2.9% of each transaction plus $0.30 per card charge

- There are no setup costs or additional monthly or annual fees

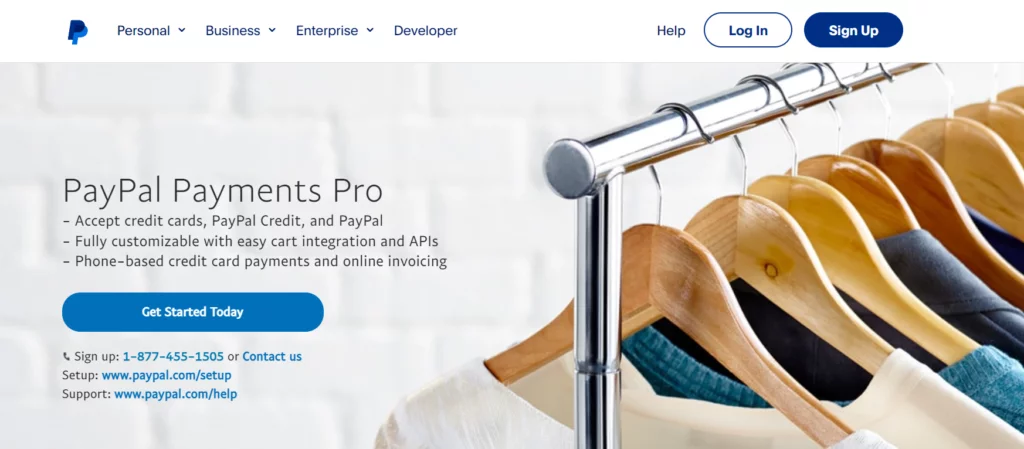

PayPal Pro

Given that PayPal is one of the oldest and most popular payment gateways, the majority of people are familiar with it. Their business solution is PayPal Pro. With support for more than 200 nations/regions worldwide, it is simple to set up and accessible from anywhere in the world. With robust anti-fraud features like Automatic fraud screening and their Seller Protection Policy, PayPal is also very secure.

With the help of PayPal Pro’s WooCommerce plugin, connecting to your WooCommerce store is simple. As a result, the setup procedure is fairly simple. The entire checkout process can be completed on a single page, saving customers from ever having to leave your website. As a result, fewer carts will likely be abandoned.

Features:

- Send customers professional-looking invoices via email

- Customize the API Quickly access your money

- Accept in-person payments using a PayPal Terminal on any computer

Pros:

- Simple to set up and use

- Available in most nations worldwide

- WooCommerce plugin support

Cons:

- Less developer-friendly

- Monthly fees some rivals don’t charge

- Larger company with fewer personal touches

Available Regions:

PayPal is accessible in more than 200 areas and nations. Payment Options PayPal accepts payments from bank accounts, credit cards (Visa, MasterCard, Discover, American Express), PayPal Cash, and PayPal.

Payment Options:

Besides credit and debit card options, PayPal offers a credit option that allows you to pay for purchases over time. Another option is ‘Pay in 4’ that allows you to split your payment into 4 smaller payments. Lastly, PayPal Cash or Cash Plus account allows you to load cash into your PayPal account at a participating retail location and use these funds to make payments.

Fees:

Depending on your location and the nature of the transaction, PayPal’s fees can vary significantly. They charge an additional 1.5% for international transactions in addition to their standard 2.9% fee per online transaction, and they also charge $30 per month for the PayPal Pro program itself.

Square

Payment gateway Square is well-known for its ubiquitous white square devices. Although the service is more geared toward physical stores, you can still accept payments online or set up an online-only store.

The service is well-made and simple to use, particularly if you have tangible goods in your store. There are many options available for business needs such as shipping, tracking, in-person pickup, and others. You can accept payments both online and in person thanks to a plugin for WooCommerce integration. This is a great way to ensure that you are always prepared to sell your goods whether you are traveling for business, attending a conference, or simply taking the subway to work

Additionally, you can accept payments through digital wallets like Apple Pay and Google Pay. WooCommerce Subscriptions and Pre-Orders also support recurring payments. Small businesses, especially local ones, that sell tangible goods should consider Square.

Features:

- WooCommerce support with plugin

- Accept payments in person or online

- Automatically sync with your in-person Square device

- Support for delivery and in-store pickup

- Coupons

- Invoices

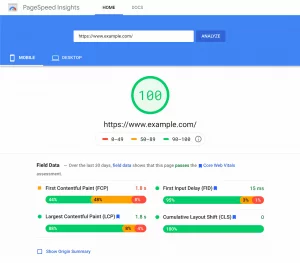

- SEO tools and optimizations

- Accept a variety of payment options, including cards, Apple Pay, Google Pay, and others

- Appointments

- Instagram integration

- Integrated with Instagram

Pros:

- Lower costs than some alternative options

- Excellent usability and design, especially for in-person transactions

Cons:

- Limited availability

- More suited to in-person sales than online eCommerce

Available Regions:

US, Canada, Japan, Australia, and UK

Payment Methods:

- Debit and credit cards

- Square gift cards

- Apple Pay

Fees:

- Google Pay Fees -2.9% + 30¢ per transaction

- Square even offers paid monthly plans that come with extra plans and discounts

Authorize.net

Visa owns and runs the payment processor Authorize.net. According to sources, it has the most users of any payment gateway in the world. For users who make significant monthly sales, it is perfect.

The service accepts more payment methods than the majority of alternatives, including Visa, JCB, PayPal, Visa SRC, Apple Pay, Chase Pay, MasterCard, Discover, American Express, and E-checks.

The integration with WooCommerce is also good. The plugin fully supports WooCommerce Subscriptions and WooCommerce Pre-Orders, and the entire checkout procedure can be completed on your website. Give Authorize.net a look if you’re a big business looking for a new payment gateway.

Features:

- Basic checkout options

- Advanced fraud detection and prevention

- Recurring payments

- Virtually any type of payment acceptance

Pros:

- Benefits from Visa’s backing

- Extensive reporting tools

- Lower rates for higher volumes

Cons:

- Not suitable for smaller businesses

- Only available to companies in the US and Canada

- Challenging to set up

Available Regions:

- The United States and Canada

Payment Options:

JCB, PayPal, Visa SRC, Discover, American Express, Apple Pay, Chase Pay,and JCB.

Fees:

Fees $25 monthly fee 2.9% plus 30 cents per transaction

Amazon Pay

The payment system run by Amazon is called Amazon Pay. The main benefit is that customers can pay for your goods and services on your website using their existing Amazon accounts. Customers can use their existing Amazon shopping accounts on outside retailers thanks to its seamless integration with other Amazon services.

This is a huge benefit given the huge number of Amazon customers there are! It specifically aids in lowering abandoned cart rates, which are frequently brought on by a lack of confidence in disclosing credit card information. Other than the transaction fees, there are no monthly fees associated with Amazon Pay.

If the customer is making an international purchase, this might also include foreign transaction fees. Additionally, the service has a free plugin to assist with process management and integrates well with WooCommerce. Customers remain on your website throughout the checkout process, increasing the likelihood that they’ll make a purchase. Additionally, there is support for multiple currencies and Amazon’s highly advanced anti-fraud technology.

Features:

- Accepting payments on your website

- Mobile optimization

- Support for small and large businesses

- Nonprofit organizations

- Customers can use their Amazon shopping accounts to make payments, and Alexa is integrated for voice ordering.

Pros:

- Makes paying seamless for customers, people already have an Amazon account

- No monthly fees or other charges

- Easy to set up and use

Cons:

- By using Amazon, they retain more customer information than if you used your own payment method.

- Amazon itself may be a competitor for products.

Available Regions:

- Amazon Pay is accessible in over 170 nations worldwide.

Payment Options:

- There are numerous payment options offered by Amazon Pay, including immediate charge, deferred payments, split payments, recurring payments, and more.

Fees:

Cost-free monthly fees, 2.9% transaction fees, and a $0.30 authorization fee

Takeaway

Choosing the right payment gateway for your WooCommerce store can have a significant impact on your sales and customer experience. In this blog, we explored some of the top payment gateways available for WooCommerce, including PayPal, Stripe, Authorize.net, Square, and Amazon Pay.

PayPal is a popular and trusted payment gateway that provides flexibility and security for your transactions. Stripe offers a user-friendly interface and a variety of payment options, while Authorize.net offers robust features and integrations for enterprise-level businesses. Square offers a seamless checkout experience and a range of payment options, while Amazon Pay provides a convenient and trusted payment method for customers.

Ultimately, the best payment gateway for your WooCommerce store will depend on your business needs, customer preferences, and transaction volume. It’s important to carefully review the fees, features, and integrations of each payment gateway before making a decision.

By offering a reliable, secure, and easy-to-use payment gateway, you can enhance your customers’ shopping experience, build trust, and drive sales for your WooCommerce store.

FAQ

How many payment methods do I need?

Even if it’s a manual payment gateway like Direct Bank Transfer, you still need to accept payments on your website using at least one payment method. The likelihood that customers will always be able to check out and complete their payment is increased by providing a variety of payment options.

Many payment gateways, including our own WooCommerce Payments, provide “express” payment buttons like Apple Pay and Google Pay in addition to standard payment card fields, giving your customers more options when checking out.

A site’s administration can become more difficult if there are too many payment gateways and methods available to customers. Make your decision based on the demands of the store and your company.

Which online payment processor works best with WordPress?

Customers’ payment preferences include major credit cards and online payment systems like PayPal. A plugin like YITH Braintree for WooCommerce, which supports both ways, is highly recommended. Even though online payment systems like Bitcoin and other digital currencies have gained traction, most shoppers still prefer traditional forms of payment.

What steps are needed to take to set up a payment gateway to accept payments?

Once you’ve processed the price, you can withdraw funds using the customer’s preferred system. Other payment methods (such as Stripe) deposit funds into an electronic wallet from which you can withdraw funds later, in contrast to PayPal’s instantaneous crediting of your account.

Do payment gateways charge a fee?

Yes. There is typically a transaction fee associated with using a digital payment method. Commonly, a percentage of the sale price is requested in addition to a small flat fee.

How much per transaction payment fee do gateways typically charge?

The exact price varies, but it’s usually between 3% and $3.0 per transaction.